News

Finance

July 11th, 2025

Constellium to Report Second Quarter 2025 Results on July 29, 2025

Constellium will host a conference call and webcast on Tuesday, July 29, 2025, at 10:00 AM (Eastern Time) to announce its second quarter 2025 results. The press release will be sent before market opening.

Business

June 24th, 2025

Constellium Honored with Three Supplier Awards from Airbus

Constellium is proud to announce that it has been recognized with three awards at the 2025 edition of Airbus’ Supply Chain & Quality Improvement Program (SQIP), held in early June.

Business

June 16th, 2025

Constellium to Exhibit at the 2025 Paris Air Show

Constellium will exhibit at the 55th edition of the Paris Air Show, taking place June 16-22, 2025 at the Paris–Le Bourget Exposition Centre (Chalet B47), one of the world’s most prestigious events for the global aerospace industry.

Sustainability

June 12th, 2025

Constellium and TARMAC Aerosave Achieve Breakthrough in Full-Circular Aluminum Recycling for End-of-Life Aircraft

Constellium, a global leader in aluminum solutions and recycling, and TARMAC Aerosave, a pioneer in aircraft & engine storage, maintenance, and eco-responsible dismantling, are proud to jointly announce a major milestone in sustainable aerospace innovation: the successful recycling and remelting of aluminum from end-of-life aircraft into new, high-performance material suitable for future aerospace applications.

Business

June 5th, 2025

Constellium Joins America Makes Project to Advance Use of Aluminum Additive Manufacturing in Defense and Aerospace

Constellium SE (NYSE: CSTM) today announced the kick off of a new collaborative project with Nikon Advanced Manufacturing (Nikon AM), America Makes, and a team of industry leaders to expand the use of its Aheadd® CP1 aluminum alloy for additive manufacturing in defense and aerospace applications.

Business

May 28th, 2025

NASA Visits Constellium Ravenswood to Celebrate Artemis Partnership

Constellium is honored to welcome NASA representatives to its Ravenswood, West Virginia facility today to celebrate their collaboration on the Artemis program — NASA’s bold mission to return humans to the Moon and pave the way for crewed missions to Mars.

Finance

May 23rd, 2025

Voting Results from Constellium's 2025 Annual General Meeting

Constellium announced today that the voting results for its Annual General Meeting of Shareholders held on May 15, 2025 (the “AGM”) have been published on the Company’s websit

Finance

April 30th, 2025

Constellium Reports First Quarter 2025 Results and Maintains Full Year 2025 Guidance

Constellium SE (NYSE: CSTM) ("Constellium" or the "Company") today reported results for the first quarter ended March 31, 2025.

Finance

April 16th, 2025

Constellium to Report First Quarter 2025 Results on April 30, 2025

Constellium will host a conference call and webcast on Wednesday, April 30, 2025, at 10:00 AM (Eastern Time) to announce its first quarter 2025 results. The press release will be sent before market opening.

Finance

April 15th, 2025

Constellium posts 2025 Annual General Meeting Materials

Constellium today announced that the Proxy Statement filed on Form 8-K and other documents for the Company’s Annual General Meeting of Shareholders to be held on May 15, 2025, at 5 PM CET (11 AM EDT), are available on its website at https://www.constellium.com/investors/shareholder-meetings and will be available to shareholders entitled to vote free of charge at the offices of the Company by contacting the Corporate Secretary at cstm.corporatesecretary@constellium.com.

Sustainability

April 3rd, 2025

Constellium honors outstanding teams at annual THANK YOU Awards

Constellium celebrated its annual THANK YOU Awards on April 2 to honor teams whose expertise and commitment have driven the company’s strategic priorities in Health & Safety, Sustainability, Customers, Operational Excellence, and Innovation.

Sustainability

March 4th, 2025

Constellium Releases 2024 Sustainability Report, Advancing a Sustainable Economy Together

Constellium today announced the release of its 2024 Sustainability Report, highlighting the company’s commitment to advancing a sustainable and circular economy.

Business

February 24th, 2025

Constellium Joins Industry Consortium for Lightweight Vehicle Chassis Innovation Project

Constellium announced its participation in ‘Project M-LightEn,’ an ambitious new initiative to develop ultra-lightweight, sustainable vehicle chassis structures.

Finance

February 20th, 2025

Constellium Reports Fourth Quarter and Full Year 2024 Results; Establishes New Long-Term Targets

Constellium SE (NYSE: CSTM) ("Constellium" or the "Company") today reported results for the fourth quarter and full year ended December 31, 2024.

Finance

February 18th, 2025

Constellium Announces Price Increase for Shipments of Flat Rolled Products in the US

Constellium today announced a minimum price increase of $0.15 per pound for all flat rolled products shipped in the US, due to recent market dynamics and other economic drivers.

Finance

February 5th, 2025

Constellium to Report Fourth Quarter and Full Year 2024 Results on February 20, 2025

Constellium will host a conference call and webcast on Thursday, February 20, 2025, at 10:00 AM (Eastern Time) to announce its fourth quarter and full year 2024 results. The press release will be sent before market opening.

Finance

January 15th, 2025

Constellium to Voluntarily Transition to Reporting in U.S. Dollars Under U.S. GAAP; Will Begin Filing Annual Reports on Form 10-K

Constellium announced today that, while it remains a foreign private issuer under applicable rules, it intends to voluntarily file its SEC reports on U.S. domestic issuer forms.

Business

December 12th, 2024

Constellium and Renault Group Conclude R&D Project Advancing Aluminium Solutions for Lighter Vehicles and Closed-Loop Recycling

Constellium announced today the successful conclusion of the “ISA3” R&D project, initiated in 2021 to enhance lightweighting in automotive design. Conducted in partnership with Renault Group, ESI Group, the Institut de Soudure (Welding Institute), and the University of Lorraine, and supported by a grant from the France Relance investment program, the project has set a benchmark for designing next-generation aluminium automotive components that are lightweight, cost-efficient, and recyclable.

Business

November 21st, 2024

Constellium Receives France 2030 Award for the “Wing of the Future” Project on the Design of the Sustainable Aircraft of Tomorrow

Constellium announced that it received a France 2030 award for its groundbreaking “Wing of the Future” project. This initiative, supported by a grant from the France 2030 investment program and implemented with the French Civil Aviation Administration (DGAC), and supported by a grant from the France 2030 investment program, supports Constellium's commitment to advancing high-performance, sustainable materials for the current and next generation of aircraft.

Business

November 19th, 2024

First Aluminium Coils from Constellium’s New Recycling Center in Neuf-Brisach Qualified by Crown

Constellium’s new recycling center in Neuf-Brisach, France, achieves a milestone by qualifying its first aluminium coils with Crown Holdings, a leader in metal packaging.

Sustainability

November 12th, 2024

Constellium Successfully Sorts Automotive Aluminium Scrap with LIBS Technology at Industrial Scale

Constellium announced a major advancement in aluminium recycling for the automotive industry, by implementing Laser-Induced Breakdown Spectroscopy (LIBS) technology at an industrial scale. This initiative, developed in collaboration with OSR GmbH & Co. KG, a German recycling specialist, and a premium European automotive manufacturer, marks a significant step in reducing carbon emissions in the automotive supply chain by increasing the use of recycled aluminium.

Finance

October 23rd, 2024

Constellium Reports Third Quarter 2024 Results

Constellium SE (NYSE: CSTM) ("Constellium" or the "Company") today reported results for the third quarter ended September 30, 2024.

Finance

October 10th, 2024

Constellium to Report Third Quarter 2024 Results on October 23, 2024

Constellium will host a conference call and webcast on Wednesday, October 23, 2024, at 10:00 AM (Eastern Time) to announce its third quarter 2024 results. The press release will be sent before market opening.

Business

October 8th, 2024

Constellium Showcases its Leading Aluminium Solutions at ALUMINIUM 2024 in Düsseldorf

Constellium is exhibiting at ALUMINIUM 2024 (Hall 3, Booth 3A49), the world's premier trade fair for the aluminium industry, taking place October 8-10 in Düsseldorf.

Sustainability

October 3rd, 2024

Constellium Receives Supplier of the Year Award from Stellantis for Strong Commitment to Corporate Social Responsibility

Constellium is proud to announce that it has received the Supplier of the Year Award from Stellantis for its strong commitment to Corporate Social Responsibility (CSR), applying strict requirements to its business and its supply chain, and receiving positive ratings from renowned international rating agencies.

Sustainability

October 2nd, 2024

Constellium Supports the 2 Million Cans Recycling Contest with Partner Schools Near Its Muscle Shoals and Ravenswood plants

Constellium is partnering with schools near its Muscle Shoals, Alabama and Ravenswood, West Virginia plants to join a recycling movement to collect empty aluminum beverage cans as part of the 2 Million Cans Recycling Contest.

Sustainability

September 26th, 2024

Constellium Announces Partnership with Tesem to "Closing the Loop" on Aluminium Recycling

Constellium is pleased to announce a partnership with Tesem, a global leader in luxury packaging, to advance sustainable aluminium production through an initiative called "Closing the Loop." This collaboration underscores Constellium’s dedication to reducing environmental impact and promoting circular economy practices.

Sustainability

September 24th, 2024

Constellium Receives Gold Award from Brandon Hall Group™ for its Global Learning and Development Programming

Constellium is proud to announce that it has received the Gold Award in the Brandon Hall Group™ “Best Corporate Learning University” category for its global learning and development programming, Constellium University.

Sustainability

September 17th, 2024

Constellium Celebrates the Grand Opening of its New Recycling Center in Neuf-Brisach, France

Constellium SE celebrates today the opening of its new advanced recycling center at its facility in Neuf-Brisach, France.

/ASI_logo_pfbfus_mldk2a.png)

Sustainability

September 10th, 2024

Constellium Achieves Aluminium Stewardship Initiative Certification for All Operations Worldwide

Constellium today announced it has achieved Aluminium Stewardship Initiative (ASI) Performance Standard Certification for all its operations, and for its corporate office in Paris.

Business

September 4th, 2024

Constellium-led ALIVE collaborative research project achieves 12 to 35 percent weight savings for EV battery enclosures with optimized designs and manufacturing processes

Constellium today announced the results of its collaborative research project ALuminium Intensive Vehicle Enclosures (ALIVE). Constellium’s University Technology Center (UTC) at Brunel University London was the lead partner of the project focused on developing structural aluminium battery enclosures for electric vehicles.

Finance

August 27th, 2024

Constellium to Appoint Bradley L. Soultz as Special Advisor to the Board of Directors

Constellium SE (NYSE: CSTM) today announced that Mr. Bradley L. Soultz will be appointed as Special Advisor to the Board of Directors in September 2024. The Board expects to put forward the nomination of Mr. Soultz as a Non-Executive Director at the Company’s Annual General Meeting to be held in 2025.

Finance

July 25th, 2024

Constellium Prices Company’s Notes Offering

Constellium SE (NYSE: CSTM) (“Constellium” or the “Company”) announced today that the Company has priced a private offering (the “Notes Offering”) of €300 million of euro denominated senior unsecured notes due 2032 (the “Euro Notes”) and $350 million of U.S. dollar denominated senior unsecured notes due 2032 (the “USD Notes” and together with the Euro Notes, the “Notes”).

Finance

July 24th, 2024

Constellium Launches Proposed Senior Notes Offering

Constellium SE (NYSE: CSTM) (“Constellium” or the “Company”) announced today the commencement of a proposed private offering of approximately €300 million of euro denominated senior unsecured notes due 2032 (the “Euro Notes”) and $350 million of U.S. dollar denominated senior unsecured notes due 2032 (together with the Euro Notes, the “Notes”), subject to market and other conditions (the “Notes Offering”).

Finance

July 23rd, 2024

Constellium’s Muscle Shoals facility receives Department of Defense grant to increase casting capacity

Constellium announced today that its facility in Muscle Shoals, Alabama has been selected by the U.S. Department of Defense (DoD) for an investment of $23 million under Title III, Defense Production Act to rebuild its Direct Chill aluminium casting center.

Finance

July 23rd, 2024

Constellium Reports Second Quarter and First Half 2024 Results

Constellium SE (NYSE: CSTM) ("Constellium" or the "Company") today reported results for the second quarter ended June 30, 2024.

Business

July 23rd, 2024

Constellium signs agreement with Lotte Infracell to supply foilstock for battery applications in Europe

Constellium signs long-term agreement with Lotte Infracell and invests to increase capacity at its Singen facility to supply foilstock for battery applications in Europe

Finance

July 15th, 2024

Constellium to Report Second Quarter 2024 Results on July 23, 2024

Constellium will host a conference call and webcast on Tuesday, July 23, 2024, at 09:00 AM (Eastern Time) to announce its second quarter 2024 results. The press release will be sent before market opening.

Sustainability

July 15th, 2024

World’s First Successful Industrial-Scale Production of Aluminium Slab Using Hydrogen Combustion

Constellium announced today the successful completion of its first industrial-scale hydrogen casting at C-TEC, Constellium's primary R&D center. This casting was performed in a 12-ton furnace following strict internal procedures. Quality monitoring, including the use of Batscan™ technology, an inclusion detection tool for molten aluminium, was conducted and no quality impact from hydrogen combustion on metal health was observed.

Manufacturing Plant

July 3rd, 2024

Constellium Facilities Impacted by Severe Flooding in Chippis and Sierre

Constellium SE (NYSE: CSTM) announced today that its facilities in Sierre and Chippis in Switzerland were impacted by exceptional flooding from the Rhone River. All operations are currently suspended. We are relieved to report that all employees are safe.

Finance

May 15th, 2024

Voting Results from Constellium's 2024 Annual General Meeting

Constellium SE announced today that the voting results for its Annual General Meeting of Shareholders held on May 2, 2024 (the “AGM”) have been published on the Company’s website

Finance

April 24th, 2024

Constellium Reports First Quarter 2024 Results

Constellium SE ("Constellium" or the "Company") today reported results for the first quarter ended March 31, 2024.

Sustainability

April 18th, 2024

Aluminium producers to boost the circularity of beverage cans

Four leading flat-rolled aluminium manufacturers and members of the European Aluminium Packaging Group (EAPG), Constellium, Elval, Novelis and Speira, have signed an agreement to engage in a standardisation project to maximise the recycled content levels of the beverage can and thus substantially lower carbon emissions, focused on increased recyclability of the can end.

Business

April 17th, 2024

Constellium received ‘Accredited Supplier’ award from Airbus

Constellium announced today that its Issoire facility, in France, received the ‘Accredited Supplier’ award from Airbus, the highest recognition in the Airbus Supply Chain & Quality Improvement (SQIP) program.

Manufacturing Plant

April 16th, 2024

Constellium transitions away from coal with the closure of its last coal-fired heat power station at its Singen facility

Constellium has announced the closure of its coal-fired power station located at its Singen facility in Germany, concluding the company's global transition away from coal usage.

Finance

April 12th, 2024

Constellium posts 2024 Annual General Meeting Materials

Constellium today announced that the notice and agenda and other documents for the Company’s Annual General Meeting of Shareholders to be held on May 2, 2024, at 5 PM CET (11 AM EDT), are available on its website

Sustainability

April 10th, 2024

Constellium and PyroGenesis partner to advance plasma burner technology in aluminium melting process

Constellium announced today the signing of a partnership agreement with PyroGenesis Canada Inc. to test the use of plasma torch technology to support Constellium’s decarbonization roadmap.

Finance

April 9th, 2024

Constellium to Report First Quarter 2024 Results on April 24, 2024

Constellium will host a conference call and webcast on Wednesday, April 24, 2024, at 10:00 AM (Eastern Time) to announce its first quarter 2024 results. The press release will be sent before market opening.

Business

March 27th, 2024

Constellium recognizes employee excellence at annual THANK YOU Awards

Constellium hosted its annual THANK YOU Awards ceremony on March 21 to celebrate teams of employees whose talent and perseverance have advanced the company’s strategy in Health & Safety, Sustainability, Customers, Operational Excellence, and Innovation.

Finance

March 25th, 2024

Constellium Ravenswood selected by US Department of Energy to receive $75 million investment to deploy low to zero carbon technology

Constellium announced today that its facility located in Ravenswood, West Virginia, was selected by the U.S. Department of Energy (DOE) Office of Clean Energy Demonstrations to begin award negotiations for up to $75 million in Bipartisan Infrastructure Law and Inflation Reduction Act funding as part of the Industrial Demonstrations Program (IDP).

Sustainability

March 20th, 2024

Constellium Releases 2023 Sustainability Report

Constellium today announced the release of its 2023 Sustainability Report. This report highlights Constellium's steadfast dedication to shaping a sustainable and circular future, showcasing the company's initiatives in various areas of sustainability.

Finance

March 19th, 2024

Constellium Files Annual Report on Form 20-F – 2023

Constellium SE has filed its annual report on Form 20-F for the fiscal year ended December 31, 2023 with the U.S. Securities and Exchange Commission. The 2023 Form 20-F is available on Constellium's website

Sustainability

March 12th, 2024

Constellium Advances Decarbonization Efforts with Industrial Testing of Hydrogen Use in Casthouses

Constellium today announced its move towards industrial testing of hydrogen utilization in its casthouses, marking a significant step in its commitment to decarbonizing its operations. Recycling and casting are the most energy intensive operations and represent close to 50% of Constellium’s direct greenhouse gas (GHG) emissions.

Sustainability

February 28th, 2024

Constellium to lead Close the Loop project to accelerate automotive aluminium circularity

Constellium SE today announced that it is leading a new R&D initiative called “Close the Loop” in partnership with an ecosystem of recycling companies in France, including INDRA (automotive recycling), GALLOO (metal recycling) and MTB RECYCLING (metal shredding & sorting).

Finance

February 21st, 2024

Constellium Reports Fourth Quarter and Full Year 2023 Results; Announces $300 Million Share Repurchase Program

Constellium SE today reported results for the fourth quarter and full year ended December 31, 2023.

Business

February 6th, 2024

Constellium Provides Chanel Fragrance & Beauty Recycled Aluminium Solutions for its Collection of Mascara

Constellium SE partnered with Chanel Fragrance & Beauty and g.pivaudran to introduce a packaging including recycled aluminium for Chanel's mascara line "Le Volume." The mascara packaging will now incorporate 10 to 20 per cent of post-consumer recycled (PCR), depending on the model.

Finance

January 31st, 2024

Constellium to Report Fourth Quarter and Full Year 2023 Results on February 21, 2024

Constellium SE will host a conference call and webcast on Wednesday, February 21, 2024, at 10:00 AM (Eastern Time) to announce its fourth quarter and full year 2023 results. The press release will be sent before market opening.

Sustainability

January 18th, 2024

First Projects Funded by ConstelliumCARES, the Company’s Newly Launched €1 million Philanthropy Program

Constellium is proud to announce that it has funded its first projects under the ConstelliumCARES Fund, a company-wide philanthropy program established in 2023 dedicated to advancing positive change in global and regional programs and local communities.

Business

January 4th, 2024

Constellium to Showcase Cutting-Edge Solutions for Aluminium Automotive Structures at CES 2024 in Las Vegas

Constellium will exhibit its latest innovations in aluminium Automotive Structures at CES 2024 in Las Vegas from January 9-12. A leading supplier of advanced lightweight aluminium automotive components, Constellium will highlight its sustainable solutions for automakers and consumers.

Business

November 20th, 2023

Constellium Celebrates a Decade of Innovation and Expertise with its International Scientific Council

Council welcomes Professor Daniel Cooper of the University of Michigan as its newest member

Finance

October 24th, 2023

Constellium Reports Third Quarter 2023 Results

Constellium SE today reported results for the third quarter ended September 30, 2023.

Finance

October 12th, 2023

Constellium to Report Third Quarter 2023 Results on October 25, 2023

Constellium SE will host a conference call and webcast on Wednesday, October 25, 2023, at 10:00 AM (Eastern Time) to announce its third quarter 2023 results. The press release will be sent before market opening.

Finance

October 4th, 2023

Constellium completes the sale of its Landau, Crailsheim and Burg facilities

Constellium announced today the completion of the sale of three of its soft alloy extrusion facilities located in Landau, Crailsheim and Burg in Germany to Vaessen Aluminium.

Sustainability

September 12th, 2023

Constellium’s operations in Muscle Shoals and Bowling Green certified by the Aluminium Stewardship Initiative (ASI)

Constellium SE today announced that it has received the Aluminium Stewardship Initiative (ASI) Performance Standard certificate for its facilities in Muscle Shoals, Alabama, and Bowling Green, Kentucky. This certification, verified by an independent third-party audit, means that the plants operate according to a strict set of governance, environmental, and social standards, including greenhouse gas emissions, biodiversity and labor rights.

Sustainability

August 29th, 2023

A Silver Award for Constellium’s Leadership Development Program

Constellium was proud to receive the Brandon Hall Group Silver Award in the “Best Unique or Innovative Leadership Development Program” category.

Finance

July 26th, 2023

Constellium Reports Second Quarter and First Half 2023 Results

Paris, July 26, 2023 – Constellium SE today reported results for the second quarter ended June 30, 2023.

Finance

July 18th, 2023

Constellium to Sell Three German Extrusion Plants to Vaessen Aluminium

Constellium SE today announced that it signed a binding agreement with Vaessen Aluminium for the sale of three of Constellium’s soft alloy extrusion facilities located in Landau, Crailsheim and Burg in Germany for a total cash consideration of €48.8 million.

Finance

July 12th, 2023

Constellium to Report Second Quarter 2023 Results on July 26, 2023

Constellium SE will host a conference call and webcast on Wednesday, July 26, 2023, at 10:00 AM (Eastern Time) to announce its second quarter 2023 results. The press release will be sent before market opening.

Blog post

June 29th, 2023

Accelerating electric vehicles with aluminium

Look around—there are more and more battery electric vehicles on the roads. And more aluminium, too.

Sustainability

June 23rd, 2023

Constellium Receives Low Carbon Award from Safran

Constellium SE is proud to announce that it has received a Safran Low Carbon Award for its Energ’Iss Project. With this award, Safran recognizes its suppliers’ commitment to reduce their carbon footprint.

Business

June 21st, 2023

Constellium awarded ‘Best Performer’ by Airbus

Constellium SE announces today that it has won the “Best Performer Award” by Airbus.

Finance

June 20th, 2023

Constellium Announces Partial Redemption of 5.875% Senior Notes due 2026

Download the press release

Business

June 19th, 2023

Constellium and TARMAC Aerosave partner to advance towards full aluminium circularity in Commercial Aviation

Constellium SE and TARMAC Aerosave will explore the development of technologies and processes to recover aluminium from end-of-life aircraft, and reutilize it within the aerospace value chain, while maintaining material properties and performance.

Finance

June 16th, 2023

Voting Results from Constellium’s 2023 Annual General Meeting

Constellium SE announced that the voting results for its Annual General Meeting of Shareholders have been published on the Company’s website

Business

June 13th, 2023

Constellium to exhibit at the 2023 Paris Air Show

Constellium will exhibit at the 54th edition of the Paris Air Show (Chalet 47), one of the largest and most prestigious events for the international air and space industries, taking place June 19-25 at Paris Le Bourget Exposition Centre.

Finance

May 24th, 2023

Constellium posts 2023 Annual General Meeting Materials

Constellium SE (the “Company”) today announced that the notice and agenda and other documents for the Company’s Annual General Meeting of Shareholders to be held on June 8, 2023, at 5 PM CET

Sustainability

May 11th, 2023

Constellium joins EPA’s ENERGY STAR® program as an Industrial Partner

Constellium SE is proud to announce its participation in the U.S. Environmental Protection Agency (EPA) ENERGY STAR® program as an Industrial Partner. This partnership further demonstrates Constellium's commitment to energy efficiency and the fight against climate change.

Business

May 2nd, 2023

Aheadd® CP1, Constellium’s high-performance aluminium additive manufacturing powder, approved for use on Formula 1 racing cars

Constellium SE announced today that its Aheadd® CP1 aluminium additive manufacturing powder was approved for use in Formula 1 cars beginning in the 2024 season. Constellium has partnered with Velo3D and PWR Advanced Cooling Technology to start providing highly efficient, compact, and lightweight heat exchangers for Formula 1 vehicles along with a variety of components for high-performance customers. Constellium is working with multiple partners on additional Aheadd® CP1-based applications.

Business

April 27th, 2023

Constellium to provide closed-loop recycling for the all-new Megane E-TECH Electric

Constellium SE announced today its agreement with Renault Group to establish a closed-loop recycling process for the all-new Megane E-TECH Electric.

Finance

April 26th, 2023

Constellium Reports First Quarter 2023 Results

Constellium SE today reported results for the first quarter ended March 31, 2023.

Finance

April 13th, 2023

Constellium to Report First Quarter 2023 Results on April 26, 2023

Constellium SE (NYSE: CSTM) will host a conference call and webcast on Wednesday, April 26, 2023, at 10:00 AM (Eastern Time) to announce its first quarter 2023 results. The press release will be sent before market opening.

Sustainability

April 12th, 2023

Catherine Athènes Elected to the Aluminum Stewardship Initiative’s Board of Directors

Catherine Athènes Elected to the Aluminum Stewardship Initiative’s Board of Directors

Business

April 5th, 2023

Constellium honors employees at annual THANK YOU Awards

Constellium hosted its annual THANK YOU Awards program on April 4 to celebrate teams of employees around the world for their strategic contributions to Health & Safety, Sustainability, Customer Service, Operations, and Innovation.

Finance

March 15th, 2023

Constellium Releases its 2022 Sustainability Report

Constellium SE published today its Sustainability Report, outlining the company’s 2022 results.

Finance

March 14th, 2023

Constellium Files Annual Report on Form 20-F - 2022

Constellium SE has filed its annual report on Form 20-F for the fiscal year ended December 31, 2022 with the U.S. Securities and Exchange Commission.

Sustainability

March 6th, 2023

Constellium discussed decarbonization initiatives at White House Roundtable

Jean-Marc Germain, CEO of Constellium, attended the Roundtable on Industrial Innovation and Decarbonization at the White House on March 3, 2023, together with senior-level officials of the Biden-Harris Administration, other major industrial companies and labor leaders, to share Constellium’s efforts to reduce its greenhouse gas emissions and discuss how the Administration and the private sector can collaborate to address climate change issues.

Finance

February 22nd, 2023

Constellium Reports Fourth Quarter and Full Year 2022 Results

Constellium SE today reported results for the fourth quarter and full year ended December 31, 2022.

Finance

February 16th, 2023

Constellium to appoint Jack Guo as Chief Financial Officer following Peter Matt’s decision to leave the Company

Constellium SE (NYSE: CSTM) announced today that, following Peter Matt’s decision to leave the Company to pursue another career opportunity, Jack Guo will be appointed Chief Financial Officer, effective April 1st, 2023.

Finance

February 8th, 2023

Constellium to Report Fourth Quarter and Full Year 2022 Results on February 22, 2023

Constellium to Report Fourth Quarter and Full Year 2022 Results on February 22, 2023 – Constellium SE will host a conference call and webcast on Wednesday, February 22, 2023, at 10:00 AM to announce its fourth quarter and full year 2022 results.

Finance

February 3rd, 2023

Constellium sells its facility in Ussel, France to Noe Industries

Constellium sells its facility in Ussel, France to Noe Industries .Constellium announced today the completion of the divestment of its Ussel plant to French Investment Holding Noe Industries.

Business

January 10th, 2023

Constellium signs a multi-year agreement to supply Daher

Constellium announced today that it has entered into a multi-year contract with Daher to supply a wide range of flat-rolled aluminium products, particularly for the TBM and Kodiak aircraft. With this new agreement, Constellium expands its customer portfolio for business and regional jets and becomes the strategic aluminium supplier for Daher.

Sustainability

December 2nd, 2022

Constellium to lead £10m CirConAl project to develop lower carbon, lower cost recycled aluminium alloys with automakers and suppliers

Constellium announced today that it is leading a new consortium of automakers and suppliers to develop lower carbon, lower cost aluminium extrusion alloys.

Business

November 10th, 2022

Constellium Supplies Aluminium Auto Body Sheet for the All-New Maserati Grecale SUV

Constellium today announced that it is supplying aluminium Auto Body Sheet for the all-new Maserati Grecale SUV.

Sustainability

November 4th, 2022

Constellium to Join the First Movers Coalition, Supporting the Aluminium Industry’s Transition to Decarbonization

Constellium announced today that it is joining the First Movers Coalition, a global initiative to accelerate zero-carbon technologies and reduce carbon emissions.

Finance

October 26th, 2022

Constellium Reports Third Quarter 2022 Results

Constellium today reported results for the third quarter ended September 30, 2022.

Finance

October 13th, 2022

Constellium to Report Third Quarter 2022 Results on October 26, 2022

Constellium will host a conference call and webcast on Wednesday, October 26, 2022, at 10:00 AM to announce its third quarter 2022 results. The press release will be sent before market opening.

Business

September 27th, 2022

Constellium showcases its extensive solutions at Aluminium 2022 around the theme "Together we care, together we grow"

Constellium exhibits at Aluminium 2022, the world's most important trade fair for the aluminium industry and its main application fields, taking place in Düsseldorf September 27-29, 2022.

Business

September 15th, 2022

Constellium celebrates expansion of its operations in Decin, Czech Republic

Today Constelliumis celebrating the expansion of its facility in Decin, Czech Republic, including a new casthouse and extrusion press to serve the growing market for automotive aluminium.

Business

September 13th, 2022

Constellium supplying aluminium Auto Body Sheet solutions to a premium car manufacturer

Constellium announced that it is supplying aluminium Auto Body Sheet solutions for the Mercedes-Benz C-Class produced in Europe, China, and South Africa and sold around the world. Constellium provides aluminium for the hood, roof, tailgate, and fenders of the Mercedes-Benz model.

Finance

July 27th, 2022

Constellium Reports Second Quarter 2022 Results

Constellium today reported results for the second quarter ended June 30, 2022.

Finance

July 18th, 2022

Constellium to Report Second Quarter 2022 Results on July 27, 2022

Constellium will host a conference call and webcast on Wednesday, July 27, 2022, at 10:00 AM to announce its second quarter 2022 results. The press release will be sent before market opening.

Blog post

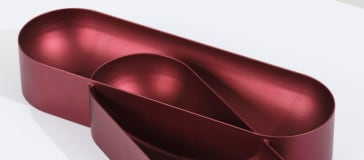

July 14th, 2022

Aluminium in Art

Aluminium is all around us—in automobiles, beverage cans, airplanes, and so much more. The qualities that make it highly practical for industrial applications also make it an appealing material for artists to play with. Not only is aluminium light, strong, flexible, and corrosion-resistant, but it can be molded, extruded, riveted, welded, and painted. It has a beautiful silvery finish, and can be polished to a high shine.

/External%20Recognitions/Logo_Ecovadis_2024_ke0qdh.jpg)

Sustainability

June 22nd, 2022

Constellium achieves highest EcoVadis Platinum sustainability rating for the second consecutive time

Constellium today announced that it has received the highest Platinum rating from EcoVadis, a leading provider of business sustainability ratings, for the second consecutive time. EcoVadis places the company in the top 1% of the 90,000 companies assessed worldwide.

Finance

June 21st, 2022

All voting items adopted at Constellium's 2022 Shareholders’ Annual Ordinary General Meeting

Constellium held its Shareholders’ Annual Ordinary General Meeting on June 10, 2022 in Paris, France. All voting items presented to the General Meeting were adopted, including the annual accounts for 2021 and the appointment of Directors.

Blog post

June 15th, 2022

The Future of Planes

In 2009, the International Air Transport Association pledged to cut emissions from air travel in half by 2050, compared to 2005 levels.

Finance

May 24th, 2022

Constellium posts Annual Ordinary General Meeting Materials, 2022

Constellium today announced that the notice and agenda and other documents for the Company’s Annual Ordinary General Meeting of Shareholders to be held on June 10, 2022, at 16:00 CET, are available on its website at www.constellium.com and will be available free of charge at the offices of the Company by contacting the Corporate Secretary at cstm.corporatesecretary@constellium.com.

Business

May 18th, 2022

Constellium and Morf3D enter a joint additive manufacturing development program

Constellium is entering into an agreement with Morf3D to provide Aheadd® CP1, one of its proprietary additive manufacturing (AM) powder solutions, to Morf3D, Inc., a subsidiary of Nikon Corporation and trusted leader in metal additive manufacturing specializing in AM optimization and engineering for the aviation, space, and defense industries.

Business

May 12th, 2022

Constellium celebrates employee achievements with THANK YOU Awards program

Constellium hosted its THANK YOU Awards on May 10 to honor employee teams for their efforts and achievements in contributing to the company’s strategic objectives. The awards program honored more than 300 employees for excellence in Health and Safety, Customer Service, Innovation, Operations, and Sustainability.

Business

May 6th, 2022

Constellium, CNRS, and Grenoble Alpes University launch the 3ALP joint laboratory dedicated to the aluminium of tomorrow

Ever stronger parts, more economical processes with less impact on the environment... these are the challenges facing metallurgy today.

Finance

April 27th, 2022

Constellium Reports First Quarter 2022 Results

Constellium today reported results for the first quarter ended March 31, 2022.

Finance

April 14th, 2022

Constellium to Report First Quarter 2022 Results on April 27, 2022

Constellium will host a conference call and webcast on Wednesday, April 27, 2022, at 10:00 AMto announce its first quarter 2022 results. The press release will be sent before market opening.

Finance

April 6th, 2022

Analyst Day 2022

Live webcast for its 2022 Analyst Day and access to the Analyst Day Presentation

Finance

March 23rd, 2022

Constellium to Host and Webcast Analyst Day on April 6, 2022

Constellium today announced details of the live webcast for its 2022 Analyst Day to be held in Muscle Shoals, Alabama. For those attending in person, a tour of the Muscle Shoals facility will follow presentations by members of the Constellium management team.

Sustainability

March 15th, 2022

Constellium releases 2021 Business and Sustainability Report

Constellium released today its 2021 Business and Sustainability Report, outlining the company’s progress on its sustainability goals as set in 2015.

Finance

March 15th, 2022

Constellium Files Annual Report on Form 20-F, 2021

Constellium has filed its annual report on Form 20-F for the year ended December 31, 2021 with the U.S. Securities and Exchange Commission. The 2021 Form 20-F is available on Constellium's website at https://www.constellium.com/investors and on the website of the U.S. Securities and Exchange Commission at www.sec.gov.

Blog post

March 8th, 2022

International Women's Day 2022

There was a time not long ago when the large majority of corporate boards tended to resemble men’s clubs. Fortunately, that has been changing. At Constellium, we are extremely proud that six of our 14 Board members are now women. And what an amazing group they are - international, multi-talented, charismatic, accomplished.

Finance

February 22nd, 2022

Constellium Reports Fourth Quarter and Full Year 2021 Results

Constellium today reported results for the fourth quarter and full year ended December 31, 2021.

Finance

February 9th, 2022

Constellium to Report Fourth Quarter and Full Year 2021 Results on February 23, 2022

Constellium will host a conference call and webcast on Wednesday, February 23 at 10 a.m. to announce its fourth quarter and full year 2021 results. The press release will be sent before market opening.

Business

January 31st, 2022

Constellium to Host Analyst Day on April 6, 2022

Constellium today announced that it will host an Analyst Day on Wednesday, April 6, 2022 in Muscle Shoals, Alabama. Analysts and institutional investors are invited to attend a series of presentations by members of the Constellium management team, to be followed by a tour of Constellium’s recycling center and rolling facility in Muscle Shoals, Alabama. A live webcast and replay of the event will be available at https://www.constellium.com/investors. Space for the event is limited and advanced registration is required. To register, click https://www.constellium.com/2022-analyst-day or contact Constellium Investor Relations at investor-relations(at)constellium.com. An agenda and webcast details will follow.

Blog post

January 14th, 2022

Industry 4.0 Digitalizing Constellium’s factories from the bottom up

Constellium, Microsoft, and Exakis Nelite have been collaborating to digitalize Constellium’s manufacturing sites, using input from the operators who work there day after day.

Blog post

December 15th, 2021

A Shiny New Sleigh

Constellium recently got a call from a surprising new customer, Santa Claus....

Business

November 15th, 2021

Constellium ranked on Forbes' inaugural list of the World's Top Female-Friendly Companies

Constellium is proud to be ranked on Forbes' inaugural list of the World's Top Female-Friendly Companies.

Blog post

November 15th, 2021

Aluminium on the Front Lines

Armored vehicles, whether wheeled or tracked, serve a variety of different functions on the battlefield: as reconnaissance, ambulance, infantry delivery vehicles. Sixty years ago, the U.S. military started using armored personnel carriers with aluminium plate. One of the first of these was the M113, a true workhorse that provided speed, agility, and safety during the Vietnam War. Aluminium made the M113 lighter than previous military vehicles yet still strong enough to protect its crew and passengers.

Business

November 7th, 2021

Constellium’s Ravenswood Facility celebrates the restart of its upgraded cold mill with a Ribbon Cutting Ceremony

Constellium celebrated today the restart of its upgraded 144-inch cold rolling mill at its facility in Ravenswood, West Virginia in the presence of Senator Shelley Moore Capito and the Deputy Assistant Secretary of Defense for Industrial Policy, Mr. Jesse Salazar. Ravenswood was awarded funding of nearly $9.5 million in 2019 by the U.S. Department of Defense (“DoD”) under the Industrial Base Analysis and Sustainment (IBAS) Program to increase throughput, quality, and performance of cold rolled aluminum.

Finance

October 26th, 2021

Constellium Reports Third Quarter 2021 Results

Constellium today reported results for the third quarter ended September 30, 2021.

Finance

October 25th, 2021

Constellium Announces Partial Redemption of 5.875% Senior Notes due 2026

Constellium today announced that it has called for redemption $200,000,000 of the $500,000,000 outstanding aggregate principal amount of its 5.875% Senior Notes due 2026 (the “Notes”, and the redemption thereof, the “Redemption”), pursuant to that certain Indenture, dated as of November 9, 2017, among the Company, the guarantors party thereto, Deutsche Bank Trust Company Americas, as Trustee. The Company expects the redemption date for the Notes being redeemed to occur on November 25, 2021 (the “Redemption Date”). The redemption price for the Notes is 101.469% of the aggregate principal amount of the Notes redeemed, plus accrued and unpaid interest, if any, to the Redemption Date.

Blog post

October 15th, 2021

Alloys: Aluminium Loves Company

Like the lead singer in a rock band, aluminium performs more brilliantly when it has backup support. In its pure state, the metal is too soft for most applications, but its intrinsic properties—low density, electrically conductive, corrosion resistant, formable, recyclable—make it a great base for developing high performance alloys.

Finance

October 14th, 2021

Constellium to Report Third Quarter 2021 Results on October 27, 2021

Constellium will host a conference call and webcast on Wednesday, October 27 at 10 a.m. (Eastern Daylight Time) to announce its third quarter 2021 results. The press release will be sent before market opening.

Business

September 22nd, 2021

Constellium to supply aluminium structural components for the new all-electric Ford F-150 Lightning

A longtime supplier to Ford, Constellium currently provides aluminium extruded components and Auto Body Sheet for 10 additional Ford and Lincoln models.

Business

September 21st, 2021

Constellium to showcase aluminium solutions for BEV battery enclosures at the CENEX Low Carbon Vehicle event on September 22-23

Constellium will exhibit aluminium solutions for BEV battery enclosures at the 14th annual CENEX Low Carbon Vehicle event (booth C3-100) at the Millbrook Proving Ground in Bedford, UK on September 22-23.

Finance

July 27th, 2021

Constellium Reports Second Quarter 2021 Results

Constellium today reported results for the second quarter ended June 30, 2021.

Finance

July 16th, 2021

Constellium To Report Second Quarter 2021 Results on July 28, 2021

Constellium will host a conference call and webcast on Wednesday, July 28 at 9 a.m. to announce its second quarter 2021 results. The press release will be sent before market opening.

Blog post

July 15th, 2021

Aluminium Shines in the Solar Power Market in Europe

Solar power is having its moment in the sun. Valued at $52.5 billion in 2018, the global market is projected to reach $223.3 billion by 2026—a compound annual growth rate of more than 20%.

Business

June 28th, 2021

Constellium supplies advanced aluminium solutions for the electric Audi e-tron GT

Constellium announced today that it has expanded its longstanding partnership with Audi to supply advanced aluminium solutions for the Audi e-tron GT.

Business

June 15th, 2021

Constellium partners with West Virginia University Parkersburg to sponsor skilled trades scholarships

As the Constellium Skilled Trades Scholarship program enters its second year, the Ravenswood facility and West Virginia University Parkersburg are celebrating 10 new student recipients with a signing ceremony today.

Blog post

June 14th, 2021

Aluminium Blasts Off

Humans build vehicles to withstand all sorts of challenging conditions: submarines that dive deep under the sea, race cars that drive full-speed for 24 hours, tanks that rumble through parched deserts. But it is hard to imagine an environment more brutal than outer space. Vehicles that travel into that region must resist extreme compression, severe turbulence, and unfathomable cold. They must be strong, lightweight, corrosion-resistant…and relatively affordable.

Finance

June 7th, 2021

Constellium set to join Russell 3000® Index

Constellium is set to join the broad-market Russell 3000® Index at the conclusion of the 2021 Russell indexes annual reconstitution, effective after the U.S. market opens on June 28, 2021, according to a preliminary list of additions posted June 4, 2021.

Sustainability

June 3rd, 2021

Constellium, the City of Issoire, and Dalkia officially launch the Energ'Iss project

With Energ'Iss, the heat recovered from Constellium’s local furnaces for aluminium production will be converted by Dalkia to provide heat and hot water to buildings and homes in the City of Issoire.

Finance

May 17th, 2021

All voting items adopted at Constellium's 2021 Annual General Meeting of Shareholders

Constellium held its Annual General Meeting of Shareholders on May 11, 2021 in Paris, France. All voting items presented to the General Meeting were adopted, including the annual accounts for 2020 and the election of directors.

Finance

May 17th, 2021

Constellium Prices Company’s Sustainability-Linked Notes Offering, 2021

Constellium today announced that the Company has priced a private offering of €300 million of Euro denominated sustainability-linked senior unsecured notes due 2029.

Finance

May 17th, 2021

Constellium Launches Proposed Sustainability-Linked Senior Notes Offering, 2021

Constellium announced today the commencement of a proposed private offering of approximately €300 million of euro denominated sustainability-linked senior unsecured notes due 2029 (the “Sustainability-Linked Notes”), subject to market and other conditions (the “Notes Offering”).

Blog post

May 15th, 2021

Ten Years On: Looking Back and Forging Ahead

As Constellium turns 10, Jean-Marc Germain, the company’s CEO, and Dick Evans, Chairman of the Board, are taking stock of this first decade, discussing the evolution they have witnessed, and sharing their views about the future. Here is an abstract of an internal webinar they recently hosted.

Sustainability

May 10th, 2021

Constellium participates in ACHIEF project to decrease Green House Gas emissions in Europe

Constellium today announced its participation in the European project ACHIEF - Innovative high-performance Alloys and Coatings for HIghly EFficient intensive energy processes. The project, launched in October 2020, gathers 11 partners from across 6 European countries and Turkey, and is dedicated to helping the Energy Intensive Industrial sector reduce the overall consumption of process energy by using new high-performance materials and protective coatings.

Business

May 3rd, 2021

Constellium celebrates its 10th anniversary

Today marks the 10th anniversary of Constellium, a global industry leader which traces its roots to aluminium pioneers Alcan, Alusuisse and Pechiney. In its first decade as a standalone company, Constellium has strengthened its position in the aerospace, automotive and packaging sectors, entered new markets, expanded its footprint, and offered ever-more innovative and responsible aluminium solutions, thanks to its integrated industrial and R&D platform, and its diverse and skilled workforce.

Finance

April 28th, 2021

Constellium Reports First Quarter 2021 Results

Constellium today reported results for the first quarter ended March 31, 2021.

Finance

April 21st, 2021

Constellium posts Annual General Meeting Materials, 2021

Constellium today announced that the notice and agenda and other documents for the Company’s Annual General Meeting of Shareholders to be held on May 11, 2021, at 16:00 CET (10:00 AM EDT), are available on its website at www.constellium.com and will be available free of charge at the offices of the Company by contacting the Corporate Secretary at cstm.corporatesecretary(at)constellium.com.

Finance

April 16th, 2021

Constellium to Report First Quarter 2021 Results on April 28, 2021

Constellium will host a conference call and webcast on Wednesday, April 28 at 11 a.m. to announce its first quarter 2021 results. The press release will be sent before market opening.

Blog post

April 14th, 2021

Making Every Day Earth Day

At Constellium, we believe our planet could use some love every day of the year, and we are constantly looking for new ways to take better care of the environment. All of our sites contribute to our environmental efforts with thoughtful and innovative ways to green their operations.

Business

April 13th, 2021

Constellium secures ISO certifications for supply of AHEADD®, high performance aluminum powders for laser powder bed additive manufacturing

Constellium today announced that C-TEC, its R&D center, has successfully secured International Organization for Standardization (ISO) certifications on quality management, environmental management, and occupational health and safety for the supply of AHEADD® aluminum alloy powders for additive manufacturing. The powders are designed and tailored to meet specific customer needs for a range of applications within the aerospace, automotive and defense industries.

Finance

March 17th, 2021

Constellium Files Annual Report on Form 20-F, 2020

Constellium has filed its annual report on Form 20-F for the year ended December 31, 2020 with the U.S. Securities and Exchange Commission. The 2020 20-F is available on Constellium's website at https://www.constellium.com/investors and on the website of the U.S. Securities and Exchange Commission at www.sec.gov.

Sustainability

March 17th, 2021

Constellium releases 2020 Business and Sustainability Report

Constellium released today its 2020 Business and Sustainability Report, outlining the company’s progress on its sustainability goals. The company is also focusing on its 2030 sustainability roadmap, with the aim to achieve climate neutrality by 2050.

Blog post

March 7th, 2021

Celebrating the women of Constellium

The aluminium industry might seem like a man’s world, and for a long time, it was. But at Constellium, our teams work with smart, talented, resourceful women every day and we thought that International Women’s Day was the perfect opportunity to highlight them.

Business

March 4th, 2021

Constellium Brings NASA’s Artemis Mission Home to Ravenswood, WV

Constellium, a supplier on NASA’s Space Launch System and Orion spacecraft, critical pieces of NASA’s return to the Moon and journey to deep space, met recently with Members of Congress and Congressional staff, including Senator Shelley Moore Capito, Senator Joe Manchin, Representative Carol Miller, and Representative David McKinley from West Virginia, to advocate on behalf of suppliers nationwide.

Finance

February 25th, 2021

Constellium Reports Fourth Quarter and Full Year 2020 Results

Constellium today reported results for the fourth quarter and full year ended December 31, 2020.

Finance

February 24th, 2021

Constellium Announces Settlement of Cash Tender Offer For Any and All of its Outstanding 6.625% Senior Notes due 2025

Constellium today announced the settlement of its cash tender offer announced on February 9, 2021 (the “Tender Offer”) to purchase any and all of its outstanding 6.625% Senior Notes due 2025 (the “Notes”).

Blog post

February 14th, 2021

Alumobility Puts the Pedal to the Metal

Constellium and Novelis, two leading players in aluminium Auto Body Sheet, have just launched a non-profit organization called Alumobility. It aspires to bring together the aluminium industry’s top minds, suppliers, and visionaries, including downstream technology partners.

Business

February 11th, 2021

Constellium’s facilities in Gottmadingen, Dahenfeld and Singen to offer ASI certified structural parts and extruded solutions

Constellium today announced its automotive structures operations in Gottmadingen and Dahenfeld, Germany, and its extrusion operations in Singen, Germany, have achieved certification according to the Aluminium Stewardship Initiative’s (“ASI”) Performance and Chain of Custody Standards.

Finance

February 9th, 2021

Constellium Provides Preliminary Fourth Quarter 2020 Results and to Report Full Year 2020 Results on February 25, 2021

Constellium today announced its preliminary fourth quarter 2020 results. The Company will announce its full year 2020 earnings results before market opening on Thursday, February 25, 2021.

Finance

February 9th, 2021

Constellium Launches Proposed Sustainability-Linked Senior Notes Offering

Constellium announced today the commencement of a proposed private offering of approximately $500 million of U.S. dollar denominated sustainability-linked senior unsecured notes due 2029 (the “Sustainability-Linked Notes”), subject to market and other conditions (the “Notes Offering”).

Finance

February 9th, 2021

Constellium Launches Cash Tender Offer For Any and All of its Outstanding 6.625% Senior Notes due 2025

Constellium today announced that it has commenced a cash tender offer (the “Tender Offer”) to purchase any and all of its outstanding 6.625% Senior Notes due 2025 (the “Notes”). The pricing terms for the Tender Offer are set forth below.

Finance

February 9th, 2021

Constellium Prices Company’s Sustainability-Linked Notes Offering

Constellium today announced that the Company has priced a private offering (the “Notes Offering”) of $500 million of U.S. dollar denominated sustainability-linked senior unsecured notes due 2029 (the “Sustainability-Linked Notes”).

Sustainability

February 4th, 2021

Constellium planning a recycling investment in Europe

Constellium today announced that it is in the advanced planning stages of an investment to increase its recycling capacity in Europe. This project will be focused on using recycled material to provide slabs for Constellium’s automotive and packaging businesses in Europe. This strategic initiative is expected to add a minimum of 60 kt of annual capacity to Constellium’s current recycling footprint, which is already one of the largest in the world.

Business

January 27th, 2021

Constellium and Novelis establish Alumobility to provide innovative, technical aluminium design solutions to advance automotive mobility

Constellium announced today, in partnership with Novelis, the launch of Alumobility, a non-profit organization focused on providing innovative implementation-ready solutions to advance the adoption of aluminium automotive body sheet. This global ecosystem of the leading aluminium and technology partners expects to drive value for automakers and consumers by helping to fulfill the promise of a lighter, more efficient, more sustainable mobility future. Through collaborative technical projects and thought leadership, as well as working in partnership with global automotive manufacturers, Alumobility’s objective is to help further develop smarter, lighter, safer, and more sustainable vehicles.

Blog post

January 18th, 2021

Celebrating The Life and Legacy of Martin Luther King Jr

As we celebrate the birthday of this great leader, we remember the way Dr. King called on each of us to understand, respect and support each other with compassion and humility. “Life’s most persistent and urgent question is, ‘What are you doing for others?’” Dr. King said. Today, let’s take a moment for conversations and reflection about diversity, equity and inclusion in our communities, our workplaces and in our everyday lives.

Business

January 14th, 2021

Constellium and Groupe Renault partner on R&D project for sustainable automotive aluminium solutions

Constellium today announced that it is leading a new R&D initiative in France, Project ISA3*. In partnership with Groupe Renault, ESI Group, Institut de Soudure (Welding Institute), and the University of Lorraine, this ~€7 million project will develop lightweight, recyclable and cost-efficient aluminium solutions for the automotive market.

Business

December 22nd, 2020

Constellium Appoints Jean-Christophe Deslarzes as Advisor to the Board of Directors

Constellium today announced that Mr. Jean-Christophe Deslarzes will be appointed as a Special Advisor to the Board of Directors in January 2021. The Board expects to put forward the nomination of Mr. Deslarzes as a Non-Executive Director at the Company’s Annual General Meeting to be held in 2021.

Blog post

December 15th, 2020

The joy of Giving in all Seasons

It is the holidays, a traditional time for giving. In the spirit of the season, we are highlighting some of the extraordinary volunteer work that employees at Constellium perform year-round. Thank you to those who generously offer their time and energy to help improve the lives of others, and happy holidays to all!

Business

December 8th, 2020

Constellium’s operations in Neuf-Brisach certified by the Aluminium Stewardship Initiative

Constellium today announced that its facility in Neuf-Brisach, France, achieved certification according to the Aluminium Stewardship Initiative’s (“ASI”) Performance and Chain of Custody Standards. This certification covers the plant’s recycling, casting, rolling and finishing operations.

Business

December 7th, 2020

Constellium announces a partnership with Project MFG to empower the future generation of American manufacturing

Constellium has agreed to join Project MFG as a Technology Partner for its Next Generation Manufacturing Challenge Series.

Sustainability

November 17th, 2020

Constellium’s Bowling Green Facility Receives Award for Lowering Carbon Emissions

Constellium is proud to announce that its Bowling Green, Kentucky facility has been recognized as an “exemplary environmental steward” by the Tennessee Valley Authority (“TVA”). Constellium’s Bowling Green plant produces flat rolled aluminium Auto Body Sheet products for the growing automotive market in North America and has a capacity of 100,000 metric tons annually.

Finance

October 27th, 2020

Constellium Reports Third Quarter 2020 Results

Constellium today reported results for the third quarter ended September 30, 2020.

Finance

October 21st, 2020

Constellium to Report Third Quarter 2020 Results on October 27, 2020

Constellium will host a conference call and webcast on Tuesday, October 27 at 10 a.m. (Eastern Daylight Time) to announce its third quarter 2020 results. The press release will be sent before market opening.

Blog post

October 15th, 2020

A Cut Above: Aluminium in Medical Devices

As the COVID-19 crisis continues to affect daily life around the world, aluminium is helping to protect first responders and save lives. From ventilator parts to the flexible nose strip in N95 masks, aluminium is an integral element in medical devices being used to fight the pandemic.

Blog post

September 14th, 2020

A toast to aluminium screwcaps

There are few disappointments greater than opening a fine bottle of wine just to find that it tastes like a musty basement. For centuries, this risk was practically unavoidable. Corks were the principal way that wine bottles were sealed (prior to that, the French used oil-soaked rags!), and the possibility of cork taint was always lurking.

Business

September 10th, 2020

Constellium to Participate in the 2020 Credit Suisse Basic Materials Conference

Constellium today announced that Jean-Marc Germain, Chief Executive Officer, and Peter Matt, Executive Vice President and Chief Financial Officer, will participate in the virtual Credit Suisse Annual Basic Materials Conference on Tuesday, September 15, 2020. The fireside chat is scheduled to begin at approximately 10:15 a.m. (Eastern Daylight Time). Live access will be available on the Constellium Investor Relations website.

Business

August 31st, 2020

Constellium’s Muscle Shoals plant receives Alabama’s Large Manufacturer of the Year Award

Constellium is proud to announce that its facility in Muscle Shoals has been honored as Alabama’s 2020 Large Manufacturer of the Year.

Blog post

August 14th, 2020

Hang Ten, Sustainably

Surfers spend a lot of time in the ocean, coming face to face with discarded plastic bottles and other pollution. Many go on to become environmental activists. Kelly Slater, considered the greatest surfer of all time, once said: “I think when a surfer becomes a surfer, it's almost like an obligation to be an environmentalist.”

Finance

July 22nd, 2020

Constellium Reports Second Quarter 2020 Results

Constellium today reported results for the second quarter ended June 30, 2020.

Finance

July 15th, 2020

Constellium to Report Second Quarter 2020 Results on July 22, 2020

Constellium will host a conference call and webcast on Wednesday, July 22 at 10 a.m. to announce its second quarter 2020 results. The press release will be sent before market opening.

Blog post

July 15th, 2020

Waving Goodbye to Plastic Bottles

Every minute, one million plastic bottles are sold around the world, most filled with drinking water. Around eight million metric tons of plastic waste end up in our oceans every year, killing fish and birds and impacting our food chain. By 2050, the seas are expected to contain more plastic, pound for pound, than fish. Researchers have even found tiny particles of plastic in bottled water. It is enough to leave a bad taste in one’s mouth.

Business

July 8th, 2020

Constellium ranked among the top 100 global automotive suppliers by Automotive News

Constellium is proud to be included in the Automotive News annual list of the industry’s top suppliers for the second year in a row, reaching #92 worldwide and #83 in North America.

Business

July 1st, 2020

Constellium releases its 2019 Business and Sustainability Report, sets its 2025 Greenhouse Gas Emissions target

Constellium released today its 2019 Business and Sustainability Report, outlining the company’s progress against its sustainability goals. The company also announced its 2025 Greenhouse Gas Emissions target: reducing GHG emissions by 25% compared with a 2015 baseline.

Sustainability

June 25th, 2020

Constellium to lead £15 million ALIVE project for the development of new aluminium battery enclosures for electric vehicles

Constellium today announced that it will lead a consortium of automotive manufacturers and suppliers to develop structural aluminium battery enclosures for electric vehicles. The £15 million ALIVE (Aluminium Intensive Vehicle Enclosures) project will be developed in the UK and funded in part by a grant from the Advanced Propulsion Centre (APC) as a component of its low carbon emissions research program.

Business

June 23rd, 2020

Constellium announces the launch of Aheadd®, its new aluminium powder offer for additive manufacturing market

Constellium today announced the expansion of its portfolio of advanced aluminium solutions with the launch of Aheadd®, a new offer for high performance aluminium powders that exceed industry standards for additive manufacturing productivity and component properties.

Sustainability

June 18th, 2020

Constellium receives Platinum rating from EcoVadis for sustainability practices

Constellium today announced that it has earned a Platinum rating from EcoVadis, a leading provider of business sustainability ratings. Platinum is the highest rating awarded by EcoVadis and places Constellium in the top 1% of companies assessed worldwide.

Finance

June 16th, 2020

Constellium Prices Notes Offering, 2020

Constellium today announced that the Company has priced a private offering (the “Notes Offering”) of $325 million of U.S. dollar denominated senior unsecured notes due 2028 (the “Notes”). The Notes will bear interest at a rate of 5.625% per annum, payable semi-annually in arrears. The Notes will be guaranteed on a senior unsecured basis by certain of the Company’s subsidiaries. The Notes Offering is expected to close on June 30, 2020, subject to customary closing conditions.

Finance

June 16th, 2020

Constellium Launches Proposed Senior Notes Offering

Constellium announced today the commencement of a proposed private offering of approximately $300 million of U.S. dollar denominated senior unsecured notes due 2028 (the “Notes”), subject to market and other conditions (the “Notes Offering”).

Blog post

June 14th, 2020

Additive Layer Manufacturing: Building the Future One Layer at a Time

At first glance, GE Aviation’s fuel nozzle tip for the LEAP jet engine is a small, banal-looking piece of equipment. But take a look inside, and you will see a highly intricate labyrinth of passages designed to mix jet fuel with air. The part is so complex, the company had difficulty producing it using traditional processes—so it turned to Additive Layer Manufacturing, or ALM. Introduced in 2015, the nozzle was a revolution: the civilian aviation market’s first part produced by additive manufacturing.

Finance

June 12th, 2020

Constellium posts Annual General Meeting Materials, 2020

Constellium today announced that the notice and agenda and other documents for the Company’s Annual General Meeting of Shareholders to be held on June 29, 2020, at 16:00 CET (10:00 AM EDT), are available on its website at www.constellium.com and are available free of charge at the offices of the Company by contacting the Corporate Secretary at cstm.corporatesecretary(at)constellium.com.

Business

June 4th, 2020

Constellium to Participate in the 2020 Deutsche Bank Global Industrials & Materials Summit

Constellium today announced that Jean-Marc Germain, Chief Executive Officer, and Peter Matt, Executive Vice President and Chief Financial Officer, will participate in the virtual Deutsche Bank Global Industrials & Materials Summit on Tuesday, June 9, 2020. The fireside chat is scheduled to begin at approximately 8:15 a.m. (Eastern Daylight Time).

Business

June 3rd, 2020

Constellium signs a multi-year contract with Airbus to supply Aerospace Aluminium Products and Solutions

Constellium announced today that it has signed a multi-year contract with Airbus. The new 10-year agreement supports all Airbus programs.

Business

May 27th, 2020

Constellium supplies Auto Body Sheet for the new Toyota Corolla in Europe

Constellium announced today that it supplies Auto Body Sheet for the new Toyota Corolla produced at Toyota’s European manufacturing plants.

Finance

April 29th, 2020

Constellium Reports First Quarter 2020 Results

Constellium today reported results for the first quarter ended March 31, 2020.

Finance

April 22nd, 2020

Constellium to Report First Quarter 2020 Results on April 29, 2020

Constellium will host a conference call and webcast on Wednesday, April 29 at 10 a.m. to announce its first quarter 2020 results. The press release will be sent before market opening.

Blog post

April 15th, 2020

The sky's the limit for flying cars

Man has been chasing the dream of a flying car for more than a century. In 1917, American aviation pioneer Glenn Curtiss unveiled his aluminium “Autoplane,” which could make short hops off the ground but never quite soared. In popular culture, the concept has sparked everything from Jules Verne’s The Master of the World to Ridley Scott’s Blade Runner. “We wanted flying cars, instead we got 140 characters,” venture capitalist Peter Thiel famously complained about our failure to build highways in the sky. But at long last, science fiction might finally become fact. And none too soon: by 2050, two-thirds of the world’s population is expected to live in cities, with all the road congestion that entails. “Urban air mobility” could be the answer, as engineers are coming up with a range of airborne vehicles - air taxis, personal helicopters, passenger drones - many driverless, and each one wilder-looking than the last.

Business

March 19th, 2020

Constellium Addresses Actions in Response to COVID-19

Constellium today announced that it will reduce or suspend activities at certain of its manufacturing sites in recognition of the disruption caused by the COVID-19 virus to our people, customers and markets. Constellium’s first priority is to protect its employees, their families and their communities.

Blog post

March 14th, 2020

Aluminium Cups are a Game Changer

At U.S. sports events, a hot dog and a beer in a plastic cup is a ritual as common as singing the national anthem. Equally as common? Those plastic cups littering the stands and streets after the game. But now, can manufacturers are aiming to offer an environmentally friendly alternative to plastic. One announced last summer that it would offer 20-oz aluminium cups as a replacement for plastic cups at a number of indoor and outdoor sports and entertainment venues across the country.

Finance

March 10th, 2020

Constellium Files Annual Report on Form 20-F

Constellium has filed its annual report on Form 20-F for the year ended December 31, 2019 with the U.S. Securities and Exchange Commission. The 2019 20-F is available on Constellium's website at https://www.constellium.com/investors and on the website of the U.S. Securities and Exchange Commission at www.sec.gov.

Finance

February 20th, 2020

Constellium Reports Fourth Quarter and Full Year 2019 Results

Constellium today reported results for the fourth quarter and full year ended December 31, 2019.

Finance

February 18th, 2020

Constellium Announces Revised Time for Fourth Quarter and Full-Year 2019 Earnings Conference Call

Constellium announced today that it has revised its fourth quarter and full-year 2019 earnings conference call time. The call is now scheduled to begin at 9:00 a.m. (Eastern Standard Time) on Thursday, February 20, 2020, one hour earlier than previously scheduled. The press release will be sent before market opening.

Blog post

February 15th, 2020

Aluminium by Design

Aluminium shone brightly at Toronto’s 10th design festival this year, where a gallery show called “Aluminum Group” featured a collection of unique objects by 15 emerging and established designers from across Canada.

Finance

February 6th, 2020

Constellium to Report Fourth Quarter and Full Year 2019 Results on February 20, 2020

Constellium will host a conference call and webcast on Thursday, February 20 at 10:00 a.m. to announce its fourth quarter and full year 2019 results. The press release will be sent before market opening.

Business

February 4th, 2020

Constellium awarded ‘Best Performer’ by Airbus - 2020

Constellium was recognized with the “Best Performer Award” by Airbus at its annual Supply Chain and Quality Improvement Program (SQIP) ceremony in Toulouse, France on January 28, 2020.

Business

January 15th, 2020

Aluminium since Antiquity

Humankind has used aluminium in one way or another as far back as ancient times, when the Greeks and Romans employed alum, an aluminium-based salt, for such things as tanning hides, dressing wounds, and fireproofing wood fortifications. But even though aluminium is the earth’s third most abundant element, it took us centuries to come up with an inexpensive way to separate the pure metal from the compounds in which it naturally occurs. As a result, throughout much of history, aluminium was considered a precious metal. One account says that Emperor Napoleon III threw a banquet where the most honored guests were given aluminium cutlery, while everyone else had to make do with gold.

Business

December 11th, 2019

Constellium’s facility in Singen to offer ASI certified aluminium rolled solutions

Constellium today announced that its casting and rolling operations in Singen, Germany, were granted the Chain of Custody certification by the Aluminium Stewardship Initiative (ASI).

Finance

November 26th, 2019

Voting Results from Constellium's Extraordinary General Meeting

Constellium announced that an Extraordinary General Meeting of Shareholders was held yesterday. The voting results for the proposals presented at the meeting have been published on our website (https://www.constellium.com/about-constellium/governance).

Business

October 29th, 2019

Constellium’s Ravenswood facility receives Department of Defense grant to optimize armor plate production

Constellium announced today that its facility in Ravenswood, West Virginia has been selected by the U.S. Department of Defense for a grant of nearly $9.5 million to increase throughput, quality and performance of cold rolled aluminum.

Finance

October 28th, 2019

Constellium posts shareholder meeting materials in connection with its contemplated move from the Netherlands to France

Constellium today announced that the invitation and other meeting materials for an Extraordinary General Meeting (“EGM”) of Shareholders, to be held on Monday, November 25, 2019, at 17:00 CET (11:00 AM EST) at the offices of Stibbe, Beethovenplein 10, 1077 WM Amsterdam, the Netherlands, have been posted on its website (www.constellium.com) and are available free of charge at the Company’s Amsterdam office. This EGM is being held in connection with the Company’s contemplated move of its corporate seat from Amsterdam, the Netherlands to Paris, France.

Finance

October 23rd, 2019

Constellium Reports Third Quarter 2019 Results

Constellium today reported results for the third quarter ended September 30, 2019.

Finance

October 10th, 2019

Constellium to Report Third Quarter 2019 Results on October 23, 2019

Constellium will host a conference call and webcast on Wednesday, October 23 at 12:00 p.m. to announce its third quarter 2019 results. The press release will be sent before market opening.

Sustainability

August 29th, 2019